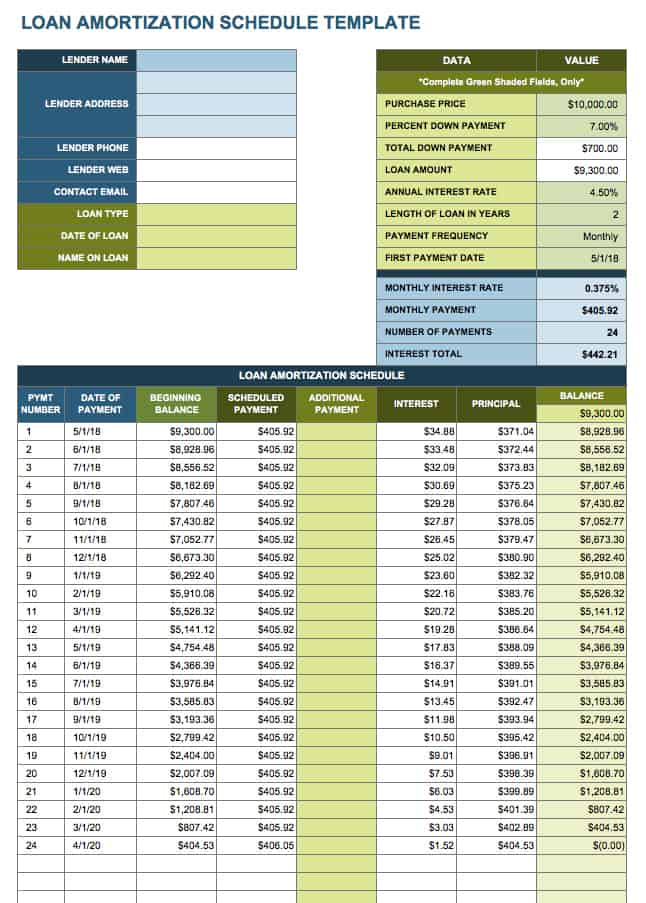

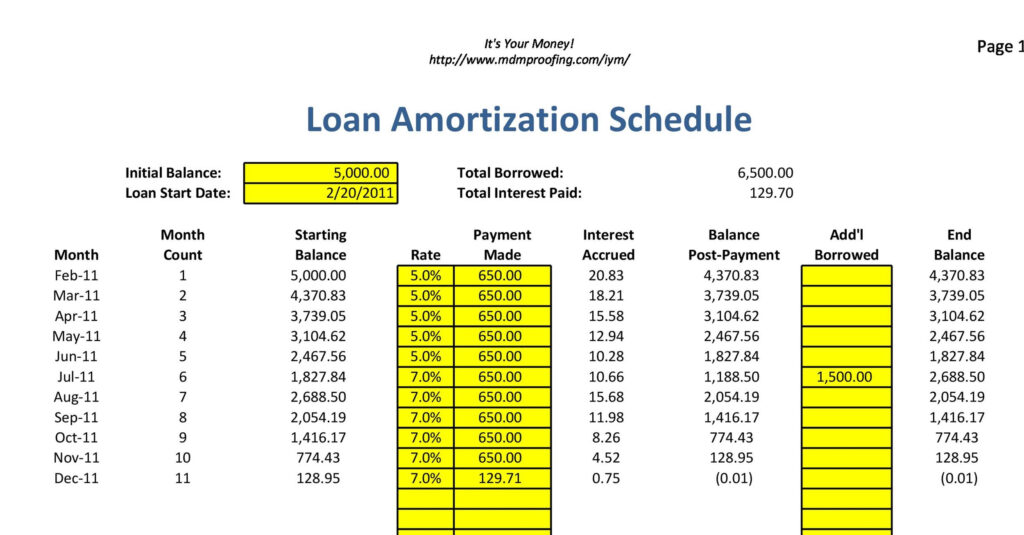

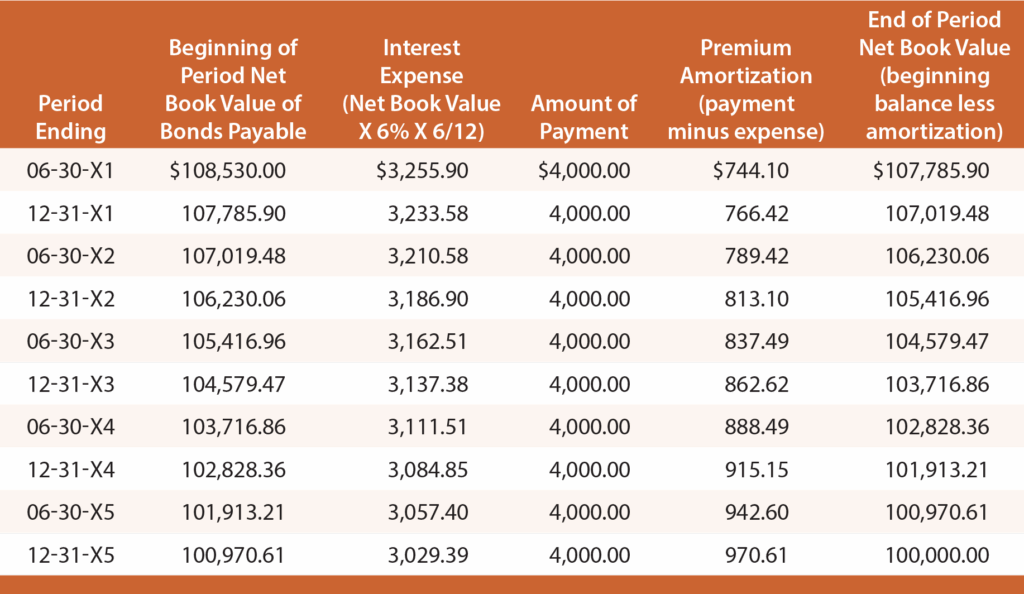

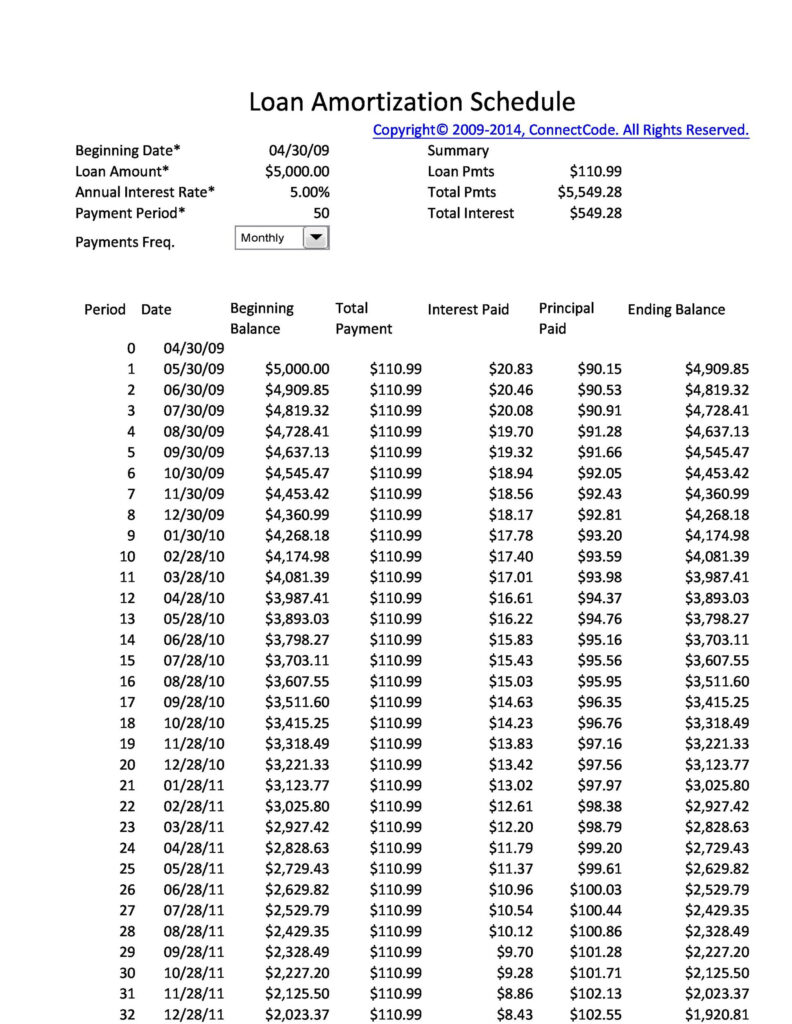

When managing multiple loans, keeping track of the repayment schedules and understanding how much you owe can be overwhelming. This is where amortization tables come in handy. An amortization table provides a detailed breakdown of each loan payment, showing how much of it goes towards principal and how much towards interest. Here’s how you can create and interpret an amortization table for multiple loans.

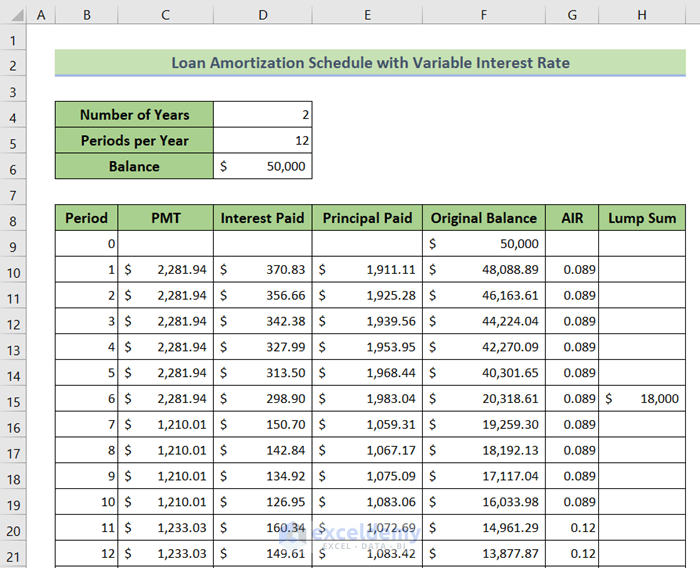

To create an amortization table for multiple loans, you will need to gather information such as the loan amount, interest rate, and loan term for each loan. Using an online loan calculator or spreadsheet software, input this information for each loan to generate an amortization table. The table will show you the monthly payment amount, the breakdown of principal and interest for each payment, and the remaining balance after each payment.

Amortization Table For Multiple Loans

Interpreting the Amortization Table

When looking at the amortization table for multiple loans, pay attention to the total monthly payment amount and how it is divided between principal and interest for each loan. You can use this information to prioritize which loans to pay off first based on the highest interest rates or remaining balance. Additionally, the table can help you understand how much of each payment goes towards reducing the principal amount, allowing you to track your progress in paying off the loans.

By utilizing amortization tables for multiple loans, you can effectively manage your debt and make informed decisions on how to allocate your resources towards repayment. Understanding the information provided in the table can help you stay on track with your financial goals and ultimately become debt-free.

Download Amortization Table For Multiple Loans

Amortization Table Problem Example Cabinets Matttroy

Amortization Table Calculator Accounting Cabinets Matttroy

Amortization Table Calculator Cabinets Matttroy

Amortization Table Calculator Cabinets Matttroy